Whether you’re starting the journey towards buying your very first home, or considering your next move, there's never been a better time to buy new.

Why rent when you can buy?

We are proud to be making homeownership as affordable and accessible as possible, with many of our homes cheaper to buy than rent when comparing with an equivalent property.

With increased rental costs combined with competitive mortgage repayments, owning a new home could be more affordable than you think. If you're a first-time buyer or looking to take the leap from renting to owning your own home, there's never been a better time to buy new.

Plus, many of our homes are available with 5% deposit contribution from Gleeson, meaning you’ll only need to find a further 5% to make your dreams of owning your own home a reality.

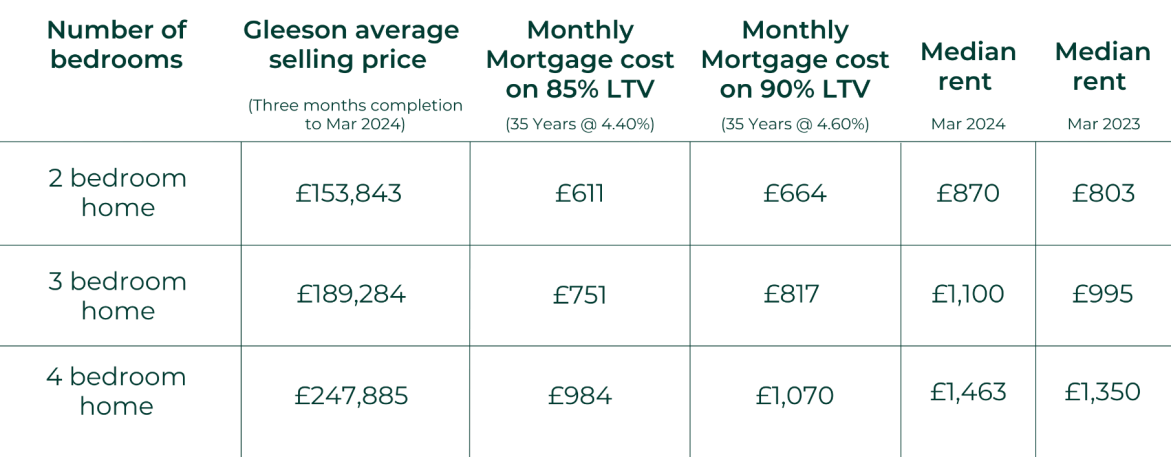

Below are some examples of median mortgage repayments on various LTV ratios vs median rental costs across the North of England and the Midlands*.

*The above figures include data provided by OnTheMarket, relating to average rental costs between two comparative periods, March 2023 and March 2024. Average costs are based on Gleeson’s two storey semi-detached or detached new build homes with a driveway, front and rear gardens included. The comparative data provided by OnTheMarket only analyses like-for-like houses, other dwelling types are excluded. Rental figures have been calculated based on median rentals in the North of England and East Midlands, as well as Staffordshire postcodes. Mortgage figures are hypothetical and are provided strictly for illustrative purposes only. Gleeson is not a mortgage provider. All figures are subject to change depending on lender criteria and Loan to Value (LTV)%. Data accurate as of March 2024. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. We recommend you seek independent legal and financial advice.